Malaysia’s listed companies now face stricter requirements under Bursa Malaysia’s Enhanced Sustainability Reporting Framework,, which aligns with global standards like IFRS S1 and S2. From 2025 onwards, issuers must provide transparent, comparable ESG disclosures,. covering governance, strategy, risks, metrics, and targets. For large-cap companies especially, data quality, assurance readiness, and supply chain engagementwill be critical to meeting investor expectations and maintaining market confidence.

At the same time, the Malaysian government, through the Ministry of Finance,is progressing on a carbon pricing framework,beginning with a voluntary carbon market (VCM), and moving toward a carbon tax under the National Energy Transition Roadmap.This means businesses must prepare for dual compliance pressures – meeting Bursa’s disclosure standards while adapting to domestic carbon pricing. Though challenging, these shifts create opportunities for Malaysian companies to attract sustainable finance, strengthen resilience, and gain a competitive edge in global capital markets.

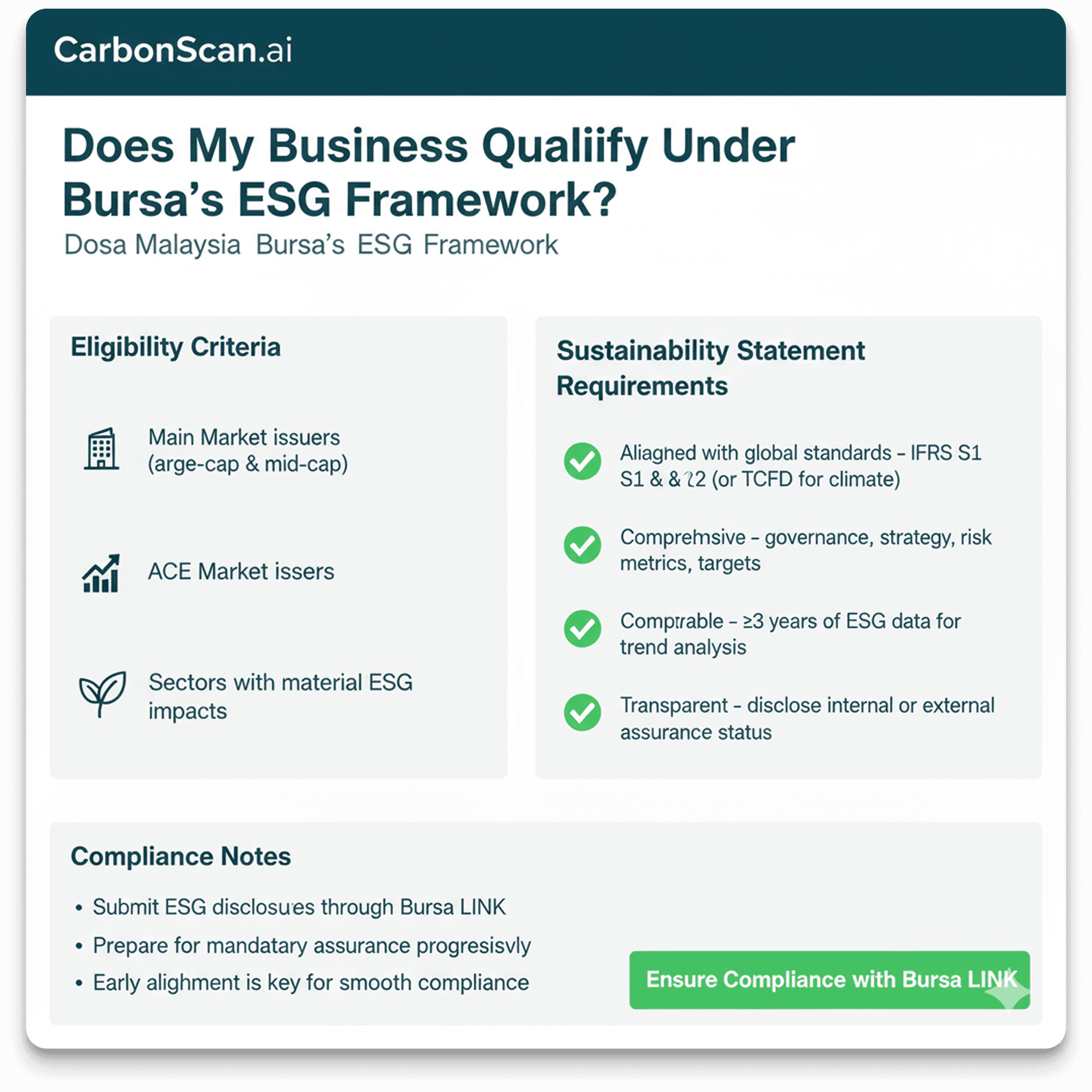

The Enhanced Sustainability Reporting Framework is Bursa Malaysia’s flagship move to align listed companies with global ESG disclosure standards and provide investors with clear, comparable data.

For Malaysian businesses, this is key as investors demand credible ESG reporting. Early adopters can stand out as sustainability leaders, attract green financing , and build long-term investor trust.

Prepare to meet Bursa Malaysia’s sustainability disclosure requirements in 3 months, with Carbon-Zero.ai’s Regulation Readiness Package. Including:

Assessing how your ESG practices, supply chain, and disclosures align with Bursa’s sustainability reporting standards.

Identifying missing data points, disclosure gaps, and areas for improvement to ensure compliance.

Access to best practices, templates, and training materials to strengthen ESG reporting across your organization

To comply with Bursa Malaysia’s enhanced sustainability reporting requirements, listed companies must disclose material ESG matters aligned with international standards such as IFRS S1 and S2.

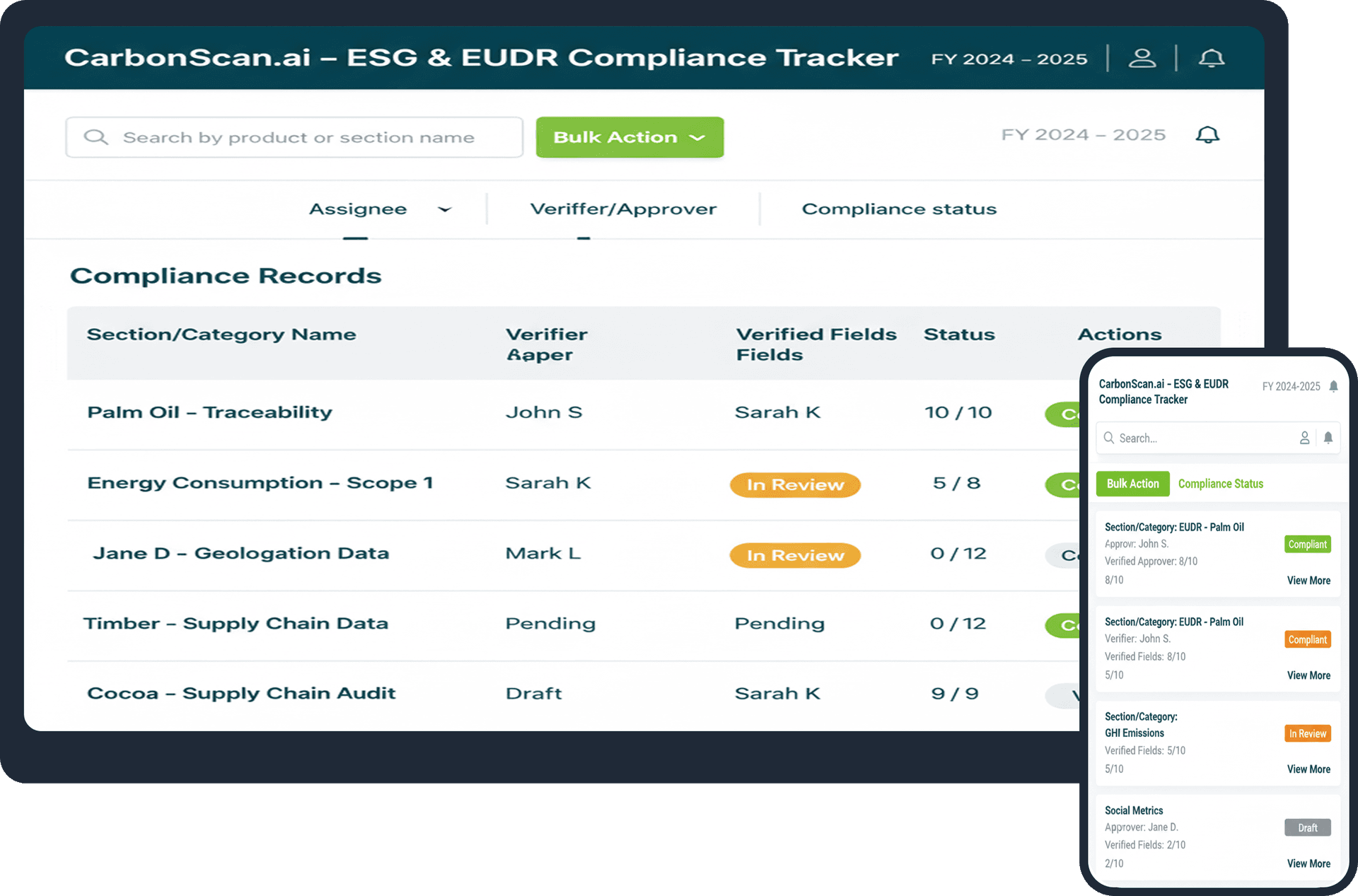

Carbon-Zero.ai helps you simplify this process by automating data collection, mapping disclosures to Bursa’s framework, and integrating assurance-ready reporting. With transparent,

accurate, and timely ESG reports, you can meet regulatory deadlines, attract investors, and strengthen your competitive position in Malaysia’s evolving market.

For more questions, please head here.

We're here to help you elevate your business. Reach out to us for expert guidance, tailored solutions, or any questions you may have.