Malaysian exporters are entering a new era of compliance as the EU’s Carbon Border Adjustment Mechanism (CBAM) , takes effect, requiring detailed reporting on embedded emissions in goods like aluminum, steel, and cement. . From 2026, full carbon cost payments will apply, making accurate data collection, verification, and supply chain transparency essential for maintaining EU market access.

At the same time, Malaysia is advancing its own carbon pricing framework, moving from a voluntary carbon market (VCM) toward a national carbon tax under the National Energy Transition Roadmap.beginning with a voluntary carbon market (VCM), This dual shift means businesses must prepare for both international reporting obligations and domestic carbon costs. While demanding, these changes also open opportunities to access green finance, improve operational efficiency, and strengthen competitivenessin global trade

TheCarbon Border Adjustment Mechanism (CBAM) and Malaysia's planned carbon tax mark a decisive shift toward pricing carbon and aligning trade with global climate policies. Exporters and high-emission industries must now demonstrate credible carbon reporting to secure market access and manage future tax exposures.

For Malaysian businesses, early preparation is crucial. Companies that adapt quickly can position themselves as low-carbon leaders, unlock access to green financing , and strengthen trust with regulators, investors, and international buyers.

Get your business ready in just 3 months with Carbon-Zero.ai’s Compliance Readiness Package, including:

Assessing how your emissions data, supply chain, and reporting align with CBAM and Malaysia’s carbon pricing framework.

Identifying missing data, verification gaps, and areas for improvement to reduce compliance risks.

Access to best practices, templates, and training resources to strengthen carbon reporting and prepare for upcoming levies.

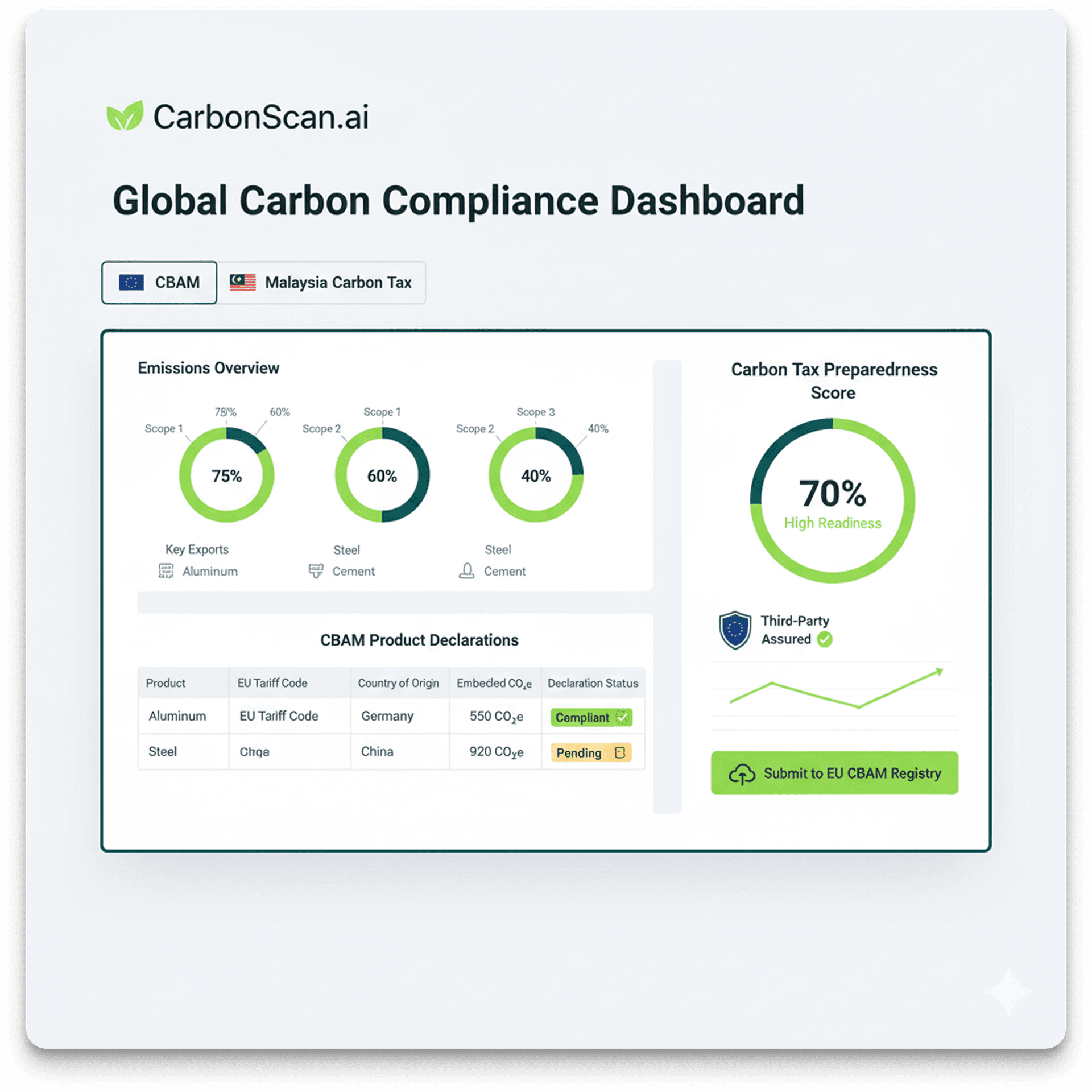

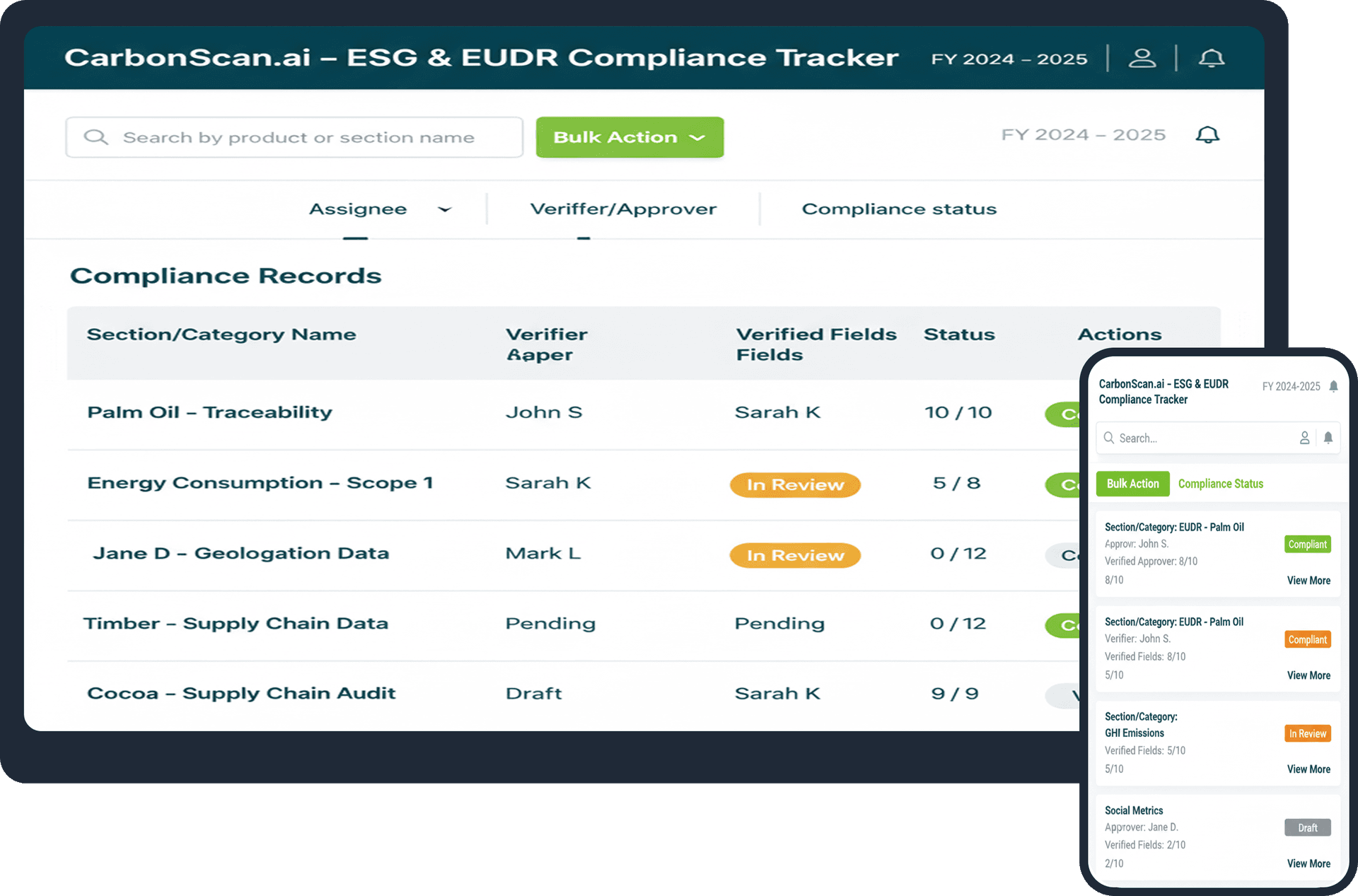

To comply with the EU’s Carbon Border Adjustment Mechanism (CBAM) and Malaysia’s upcoming carbon tax framework, businesses must capture, calculate, and report embedded emissions with accuracy. Carbon-Zero.ai simplifies this process by automating emissions data collection, mapping carbon footprints to CBAM requirements, and generating assurance-ready reports. With transparent, verifiable, and timely disclosures, you can reduce compliance risks, maintain EU market access, and stay ahead in Malaysia’s low-carbon transition.

Powered by CarbonScan.ai

Powered by CarbonScan.ai

Powered by CarbonScan.ai

For more questions, please head here.

We're here to help you elevate your business. Reach out to us for expert guidance, tailored solutions, or any questions you may have.