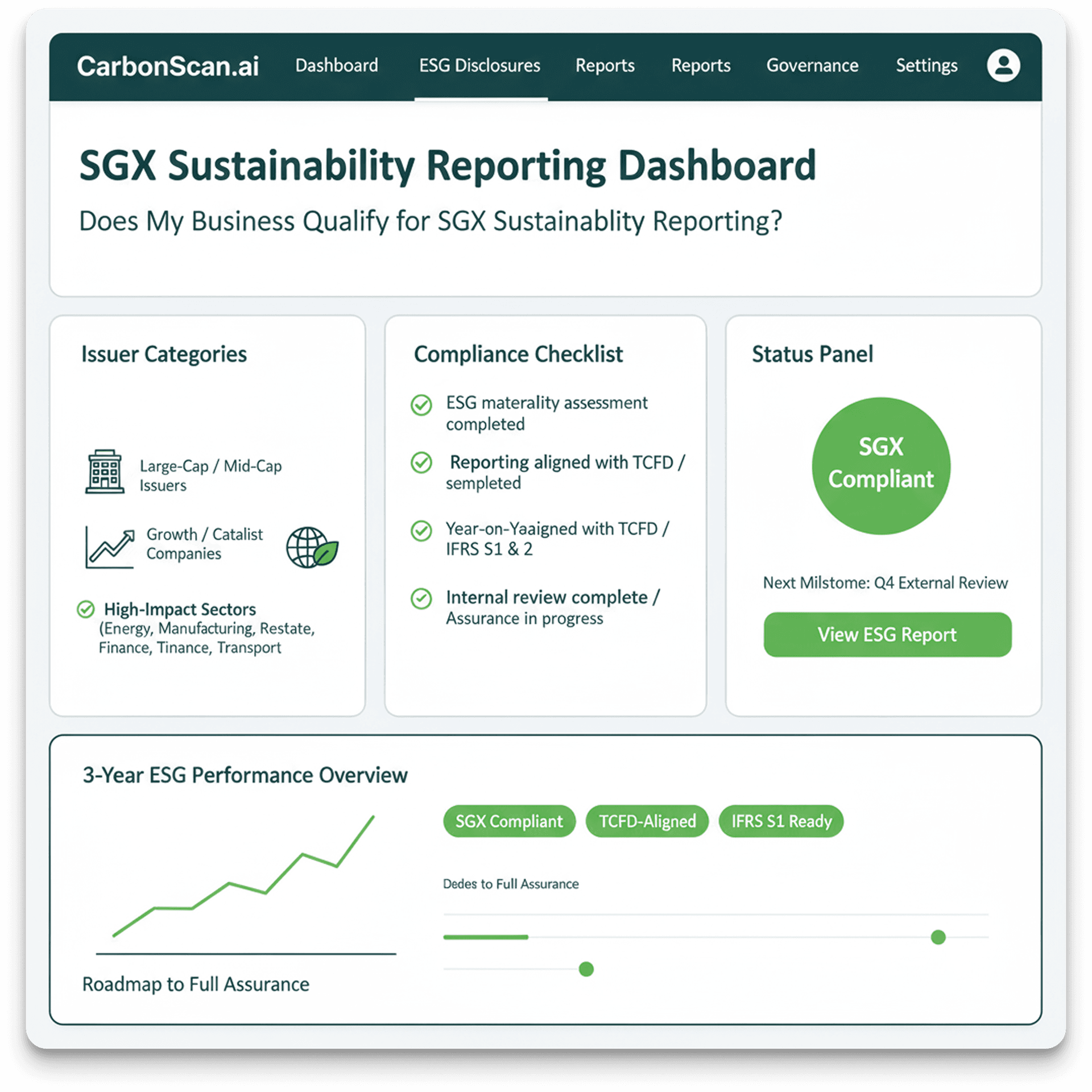

Singapore is positioning itself as a leader in sustainable finance, and the Singapore Exchange (SGX), sustainability reporting framework is central to this transition. Unlike voluntary ESG initiatives, SGX mandates listed companies to disclose material environmental, social, and governance (ESG) factors aligned with international standards such as TCFD and IFRS S1 & S2.

SGX reporting strengthens transparency, investor trust, and market confidence by requiring companies to provide verified, comparable data on climate risks, emissions, governance, and sustainability targets. For businesses, SGX compliance is no longer just a regulatory obligation—it is a strategic opportunity to attract global capital, build resilience, and position themselves as credible, future-ready leaders in a fast-evolving sustainable economy.

TheSGX Sustainability Reporting Framework is a globally aligned standard that ensures listed companies disclose material ESG factors, manage climate-related risks, and uphold transparent governance.

For businesses, SGXcompliance is critical to meeting investor expectations, strengthening market confidence, and securing long-term competitiveness in a world where sustainable performance drives capital flows.

Get compliance-ready in just 3 months with Carbon-Zero.ai’s SGX Readiness Package, including:

Assess how your ESG disclosures align with SGX sustainability reporting requirements.

Identify missing data, disclosure gaps, and areas for improvement.

Access best practices, templates, and training to strengthen ESG reporting across your organization.

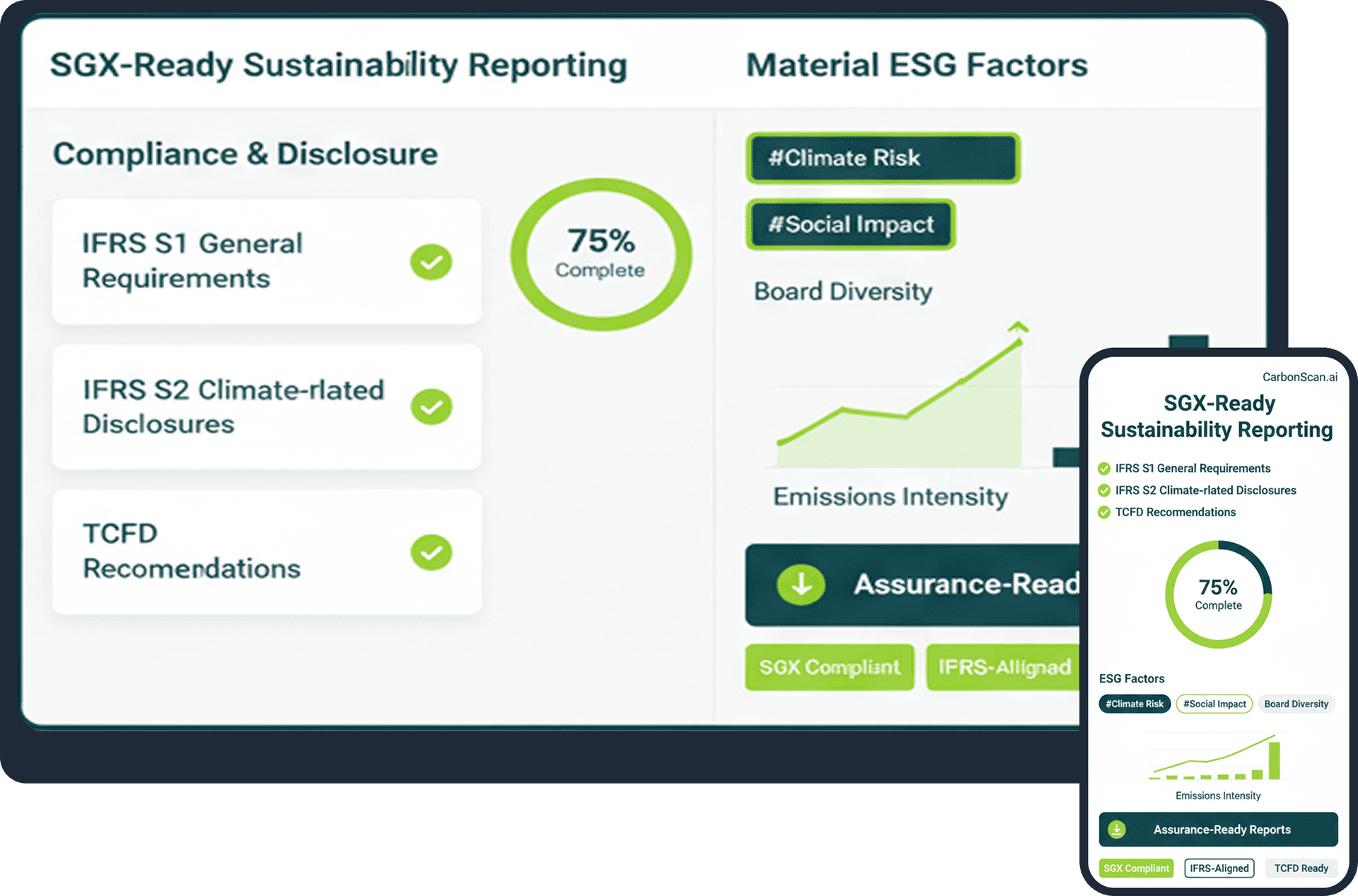

To comply with SGX’s sustainability reporting framework, listed companies must disclose material ESG factors aligned with global standards such as IFRS S1 & S2 and TCFD.

Carbon-Zero.ai simplifies this process by automating ESG data collection, mapping disclosures to SGX requirements, and generating assurance-ready reports.

With accurate, transparent, and timely reporting, you can streamline compliance, build investor confidence, and strengthen your competitive edge in Singapore’s capital markets.

For more questions, please head here.

We're here to help you elevate your business. Reach out to us for expert guidance, tailored solutions, or any questions you may have.